- TRANSACTION PRO PDF

- TRANSACTION PRO PRO

- TRANSACTION PRO VERIFICATION

- TRANSACTION PRO CODE

- TRANSACTION PRO PLUS

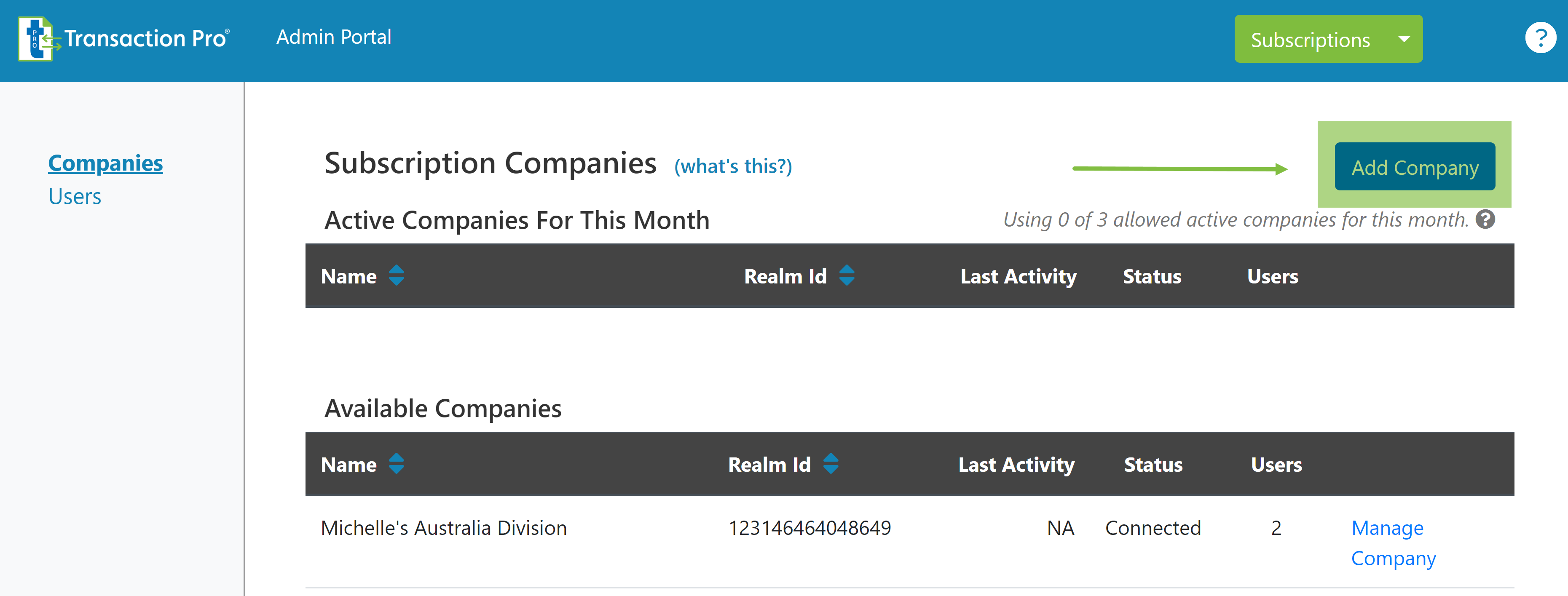

Integrating these applications with QuickBooks can help in simplifying business processes, especially their finances. Small and medium businesses use a wide range of applications to manage their businesses.

TRANSACTION PRO PRO

The inactivity fee will be the lesser of the fee listed below or the remaining balance in your account.How to Integrate Transaction Pro with QuickBooks? See Credit Card and Debit Card Link and Confirmation Table below.

TRANSACTION PRO VERIFICATION

This amount will be refunded when you successfully complete the credit card or debit card verification process. Some users, in order to increase their sending limit or as PayPal may determine, may be charged a Credit Card and Debit Card Link and Confirmation fee.

TRANSACTION PRO PLUS

Virtual Terminal - Interchange Plus Fee Structure: Virtual Terminal - Blended Pricing Fee Structure: Virtual Terminal - Standard PayPal Payment using Express Checkout: Website Payments Pro - Interchange Plus Fee Structure: Website Payments Pro - Blended Pricing Fee Structure:

Website Payments Pro - Standard PayPal Payment using Express Checkout Interchange Plus Fee Structure: Visa, MasterCard or Maestro card types including the use of:Īdvanced Credit and Debit Card Payments - Blended Pricing Fee Structure: Īdvanced Credit and Debit Card Payments - Interchange Plus Fee Structure: Payments from another PayPal account via PayPal Location Based Payments FunctionalityĪggregate monetary amount of PayPal Here transactions and commercial transactions received in the previous calendar monthīlended Pricing Fee Structure: American Express card payment made:īlended Pricing Fee Structure: Visa, MasterCard, or Maestro card payment made:.Interchange Plus Fee Structure: American Express card payment made: Interchange Plus Fee Structure: Visa, MasterCard or Maestro card payment made: using the PayPal Here Card Reader’s Chip and Pin, Chip and Signature functionality orīlended Pricing Fee Structure: Visa, MasterCard, Maestro, or American Express card payment made :.

TRANSACTION PRO CODE

For a complete listing of PayPal market codes, please access our Market Code Table.īlended Pricing Fee Structure: Visa, MasterCard, Maestro, or American Express card payment made: Market Code Table: We may refer to two-letter market codes throughout our fee pages. International transactions where both the sender and the receiver are registered with or identified by PayPal as resident in the United Kingdom, Guernsey, Jersey, Isle of Man are treated as domestic transactions for the purpose of applying fees. For a listing of our groupings, please access our Market/Region Grouping Table. Certain markets are grouped together when calculating international transaction rates. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Domestic:A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’.

You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page.

TRANSACTION PRO PDF

Download printable PDF Last Updated: 1, August 2022

0 kommentar(er)

0 kommentar(er)